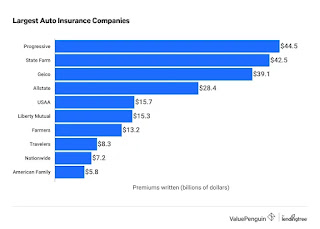

The 10 largest insurance companies in the United States write 70% of all the car insurance premiums. Progressive has the biggest market share, with 14% of all premiums.

oklahoma auto insurance quotes

The biggest companies offer stability, along with a wider range of coverage options than you may find at a typical smaller insurer. But they vary on price, service quality and many other characteristics. To choose the best insurance company for you, review the list of the 10 largest auto insurance companies in the U.S. and what makes each of them unique.

COMPARE VEHICLE INSURANCE

What are the largest auto insurance companies?

Progressive is the No. 1 auto insurance company in the country in terms of market share, followed by State Farm, Geico and Allstate.

insurance companies okc

When looking at the rankings of the top auto insurance companies in the United States, most of the names are recognizable due to their name brands that include national television advertising campaigns.

cheapest auto insurance reddit

1. Progressive

2. State Farm

State Farm is the second-largest auto insurance company in the U.S. and controls just under 14% of the market.

The company currently employs approximately 53,000 employees and has nearly 19,000 agents. State Farm operates as a mutual insurance company, meaning that its policyholders own it.

what is insurance deductible

Among the largest widely available car insurers on this list, State Farm offers the cheapest car insurance rates in most of the U.S.

3. Geico

Geico, known for its advertisements featuring an animated gecko, has served as an underwriter to more than 16 million auto policies, which insure more than 24 million vehicles. The company's size allows it to employ more than 43,000 people across 18 offices nationwide.

what is premiums in insurance

Geico's original customer base consisted of U.S. government employees and military personnel. Today, the insurance company sells insurance to drivers of all stripes across the country.

Geico has the best car insurance for college students, according to our research.

4. Allstate

Established in 1931, Allstate is the second-largest publicly traded property and casualty insurance company in America. Like State Farm, Allstate has a roster of local agents ready to serve your needs. The company currently employs more than 54,000 people.

5. USAA

USAA was founded in San Antonio in 1922 by 25 Army officers who decided to insure each other's vehicles. Today, the company serves millions of members associated with the U.S. military, including current and former service members, family members of service members and cadets or midshipmen.

fort myers auto insurance

Coverage from USAA is only available if you have served in the U.S. military or if your spouse or parent has had insurance from USAA at some point in their life.

auto insurance connecticut

Because of its focus on the U.S. armed forces, USAA is our top pick for the best and cheapest car insurance for veterans and military service members.

6. Liberty Mutual

Liberty Mutual is one of the largest insurance companies in the U.S. and has been around for more than 100 years. It also has a large international presence, with operations in 29 countries. Besides car insurance, the company sells property and casualty, health and life insurance policies.

You can get Liberty Mutual auto insurance through the company's call center or website, a local Liberty Mutual agent or broker, or representatives from its network of regional subsidiaries. One benefit of Liberty Mutual is that after you sign up, your rates are guaranteed for a year.

7. Farmers

Farmers began as an insurance company providing coverage to farmers' vehicles. Since then, it has evolved to become the seventh-largest insurance company in the country.

It’s hard to find an insurance company that offers more products than Farmers. It offers auto insurance, pet insurance and even investment products, among other insurance products. Farmers employs nearly 21,000 people, underwriting more than 19 million policies across all 50 states.

definition collision insurance

8. Travelers

Travelers is more than 160 years old, making it one of the oldest insurance companies operating today. In fact, Travelers issued its first auto insurance policy in 1897, before the Ford Model T was invented.

The company has more than 30,000 employees and 13,500 independent agents and brokers in multiple countries, including the United States, Canada and Brazil.

9. Nationwide

Nationwide offers financial services, commercial lines and personal lines in all 50 states. The company has contributed more than $585 million to nonprofit organizations since 2000.

Among the largest car insurance companies, Nationwide offers one of the best deals for customers looking to bundle their home and auto insurance policies.

10. American Family

American Family was originally established to insure farmers' crops. In the 1930s, the company expanded and began to focus on insuring nonfarmers as well. Today, the company is one of the biggest insurance companies in the U.S., especially in Midwestern states like Wisconsin, Kansas and Minnesota.

List of the largest car insurance companies by state

Although it's the most popular insurance company nationwide, Progressive is the largest company in just 15 states. State Farm is the top choice in 24 states, and Geico is the biggest in nine states. Allstate and Mapfre account for one state each.

hail damage car insurance claim

Big vs. small insurance companies

The trade-off between large insurance companies and small ones typically involves giving up the competitive rates and financial stability of a large company for an improved customer experience with a small company.

When working with a small insurance company for your auto insurance, you'll likely communicate exclusively with one insurance agent. However, it may be more challenging to get in contact with them if you're stuck in the middle of the night or you're far from your home. It's also possible that a smaller regional company could be more vulnerable to regional perils. A hailstorm that damages 10,000 cars in one city may put a regional insurance company out of business; a national company can spread that expense across a country's worth of insurance policies.

To help you choose the best company for you, we compared the 10 largest auto insurance companies according to our editor's rating, J.D. Power score and financial strength rating by AM Best. USAA and State Farm are our top recommendations overall, though USAA is only available to people connected to the military.

Mutual vs. stock insurance companies

There are two main ownership structures insurance companies can have: a mutual company and a stock company. Stock companies are privately owned or publicly traded insurance companies that offer voting rights to stockholders. Mutual insurance companies, however, are owned by their policyholders, meaning the companies' profits are paid back to their customers.

Most of the top 10 largest auto insurance companies are stock insurance companies, excluding USAA, which is an insurance exchange for military personnel.

How to find the right insurance for you

With all the large auto insurance companies out there, it's still important to pick the best company for your unique situation. We always recommend comparing quotes from multiple insurers in order to find cheap rates that fit your personal driver profile and history.

Minimum-coverage car insurance is specified by the minimum auto insurance requirements in your state. Full-coverage car insurance adds comprehensive and collision coverage to your policy in order to protect you against physical damage to your vehicle.

car accident other driver has no insurance

We typically suggest all drivers consider full-coverage car insurance, particularly if their car is worth more than $3,000 or under 10 years old.